How to File Taxes in India: A Simple Guide

Filing taxes in India may seem daunting, but with the right steps, you can complete it smoothly. Paying taxes is an important responsibility for all eligible Indian residents, and it can also help you access various financial benefits. Here’s a step-by-step guide on how to file your income tax return (ITR) in India.

Determine Your Eligibility for Filing an Income Tax Return

The Income Tax Act requires individuals with annual incomes above a specific threshold to file their taxes. The income tax slabs vary based on factors like age and income source. As of the current tax year, the exemption limit for individuals under 60 is ₹2.5 lakhs, with different slabs for senior citizens and super senior citizens. Even if your income falls below the taxable limit, filing taxes can be beneficial as it provides proof of income and eligibility for loans.

Gather Required Documents

To file your taxes, you’ll need to have the following documents on hand:

PAN Card: A Permanent Account Number (PAN) is mandatory for filing taxes.

Form 16: Provided by your employer, it summarizes the salary, tax deductions, and taxes deducted at source (TDS).

Bank Statements: These reflect your income, including interest and other earnings.

Investment Proofs: If you have invested in tax-saving instruments like PPF, ELSS, or life insurance, keep these documents ready.

Home Loan and Education Loan Statements: Interest paid on home and education loans may be eligible for deductions.

Other Income Proofs: Include rental income, capital gains, or business income, if applicable.

Choose the Correct ITR Form

The Income Tax Department provides different ITR forms based on the source and amount of income. Here’s a quick overview:

ITR-1: For individuals with income up to ₹50 lakhs from salary, one house property, and other sources.

ITR-2: For individuals with income from multiple sources but not from business or profession.

ITR-3: For individuals with income from business or profession.

ITR-4: For individuals opting for the presumptive income scheme under Sections 44AD, 44ADA, and 44AE.

It’s essential to choose the correct form, as using the wrong form can lead to penalties or rejection of your return.

Calculate Your Taxable Income and Deductibles

Start by adding up all sources of income. Subtract eligible deductions under sections like 80C (for investments), 80D (for medical insurance), 80E (for education loans), and others. This calculation gives your total taxable income.

Use the income tax slabs to compute your tax liability. If you’ve already paid advance tax or if TDS has been deducted, you can adjust this amount against your final tax liability.

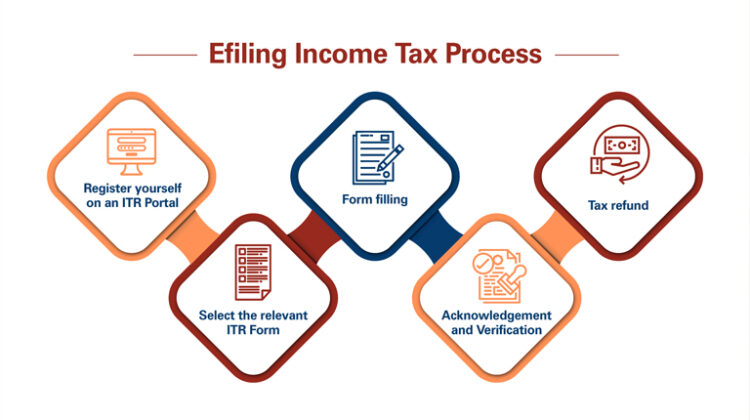

File Your Return on the Income Tax e-Filing Portal

The Income Tax Department has simplified tax filing with its e-Filing portal. Here’s how to file:

Log in to www.incometax.gov.in using your PAN and password.

Select ‘e-File’ and choose ‘Income Tax Return’ from the menu.

Fill in required details, upload documents if necessary, and select the relevant ITR form.

Review your filled return and confirm accuracy.

Submit the return. You will receive an acknowledgment in ITR-V form.

Verify Your Income Tax Return After submitting, verify your return within 120 days. You can verify it online via Aadhaar OTP, net banking, or by sending a signed ITR-V form to the Centralized Processing Centre in Bengaluru.